Khushhali Microfinance Bank Limited Jobs 2024

In Pakistan, KMBL stands out among the top microfinance institutions. Its primary objective is to facilitate the acquisition of necessary capital for individuals, entrepreneurs, and small businesses in both urban and rural regions. The establishment of Khushhali Microfinance Bank in the year 2000 marked a watershed moment in the fight against poverty, increased economic empowerment, and the expansion of access to formal financial services across the nation.

Khushhali Microfinance Bank Limited’s most salient features include:

Microfinance Services: KMBL caters to a wide variety of clientele by offering a wide range of financial products and services. Among these services are digital banking choices, microcredit loans, savings accounts, insurance, money transfers, and more. The bank’s goal is to empower individuals and small businesses by providing them with affordable and accessible banking services.

Khushhali Microfinance Bank places a premium on customer satisfaction because it values its clients and strives to establish lasting relationships with them. The bank’s dedication to its customers is evident in its individualised service, prompt resolution of customer concerns, and ongoing efforts to comprehend and fulfil its customers’ financial requirements.

One of the primary objectives of KMBL is to provide access to formal banking services for underprivileged and underserved communities, particularly in rural areas. In more inaccessible areas, the bank’s network of branches and agents facilitates financial services. Because of this, it can extend its services to those without bank accounts and aid the expansion of smaller enterprises.

Khushhali Microfinance Bank’s Financial Inclusion Programmes aim to promote economic empowerment by providing underprivileged communities with access to banking services. The bank is involved in initiatives spearheaded by the government to broaden people’s access to banking services. To name a few, there is the Prime Minister’s Kamyab Jawan Programme, which seeks to assist young people in establishing their own enterprises and securing employment, and the National Financial Inclusion Strategy (NFIS).

Innovative Use of Technology: KMBL’s financial services are enhanced by the utilisation of technology, which makes them more accessible, efficient, and convenient. The bank’s digital platforms, mobile banking apps, and online account management tools allow customers to do business, access account information, and use banking services remotely. When it comes to financial inclusion, these new technologies are great because they help bridge the gap between urban and rural residents.

Social Impact: Khushhali Microfinance Bank isn’t simply a lender. Efforts to better people’s lives, schools, healthcare, and the environment are also backed by social development projects. In order to support community-based and socially beneficial projects, the bank collaborates with development partners, non-governmental organisations (NGOs), and government organisations.

Good governance and adherence to regulations: KMBL abides by the directives and regulations issued by the State Bank of Pakistan (SBP) and other significant regulatory agencies. The financial institution adheres to norms of good corporate governance, sound risk management, and regulatory compliance. Its operations are guaranteed to be transparent, truthful, and answerable in this way.

Khushhali Microfinance Bank Limited plays a crucial role in Pakistan’s efforts to promote equitable growth, alleviate poverty, and advance society at large. Access to financial services, empowerment of businesses, and support for community development projects are three ways KMBL contributes to a more equitable and successful society.

Educational Qualification: Bachelors in Business Administration from a HEC recognized / overseas universities.

Skills:

- The candidate must possess strong analytical, interpersonal, and communication abilities, as well as the capacity to adapt to a

- dynamic work environment and carry out all duties to the exacting standards expected of them.

- Competent in addressing all common inquiries and questions

- I am comfortable working in a tech-driven setting and have excellent skills in word processing, spreadsheet, and presentation tools.

Duration and Nature of Previous Experience:

Preferably 2 of experience within a bank/financial institution.

Knowledge of Administrative / Management function would be an added advantage.

Note:

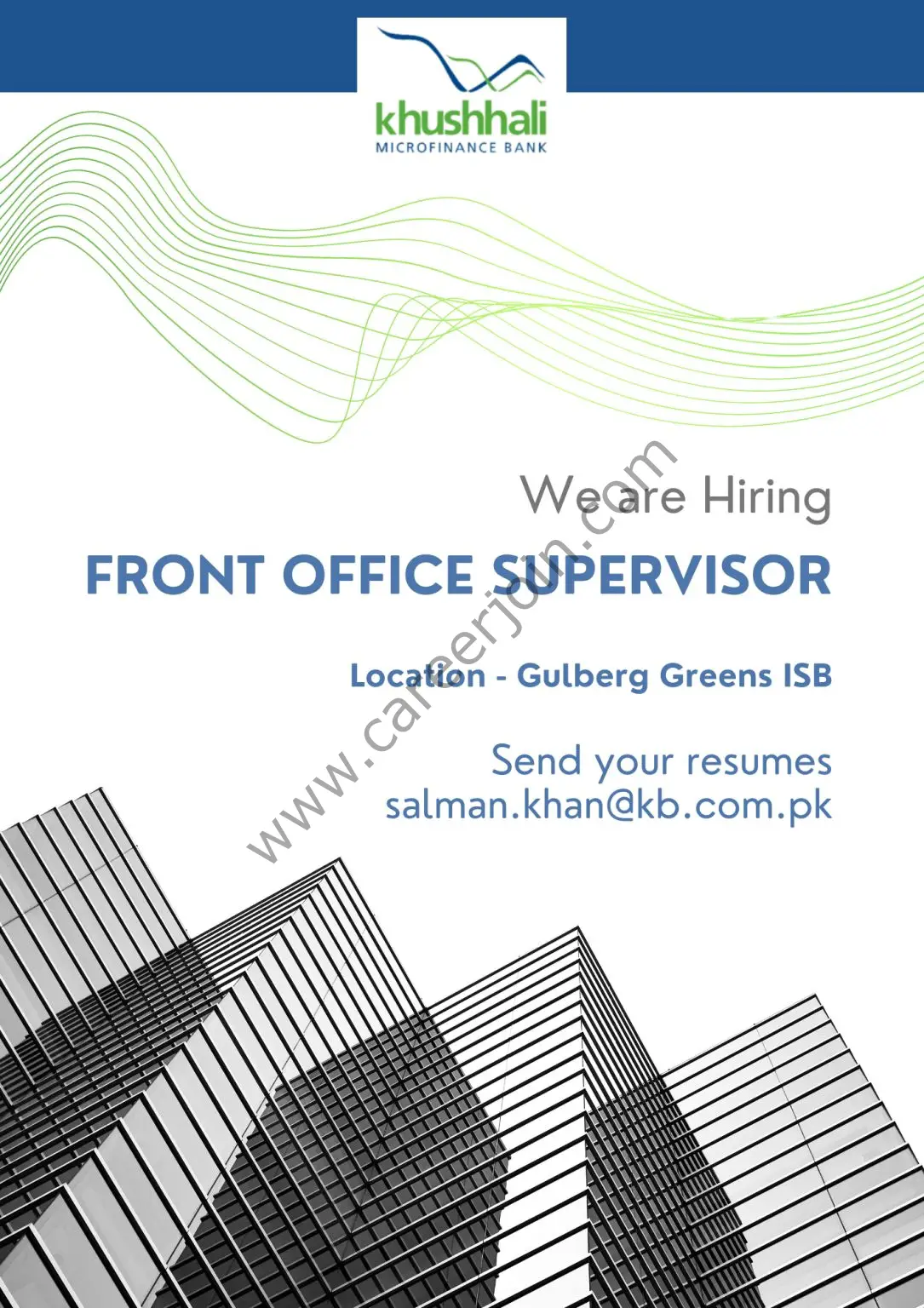

- Pay close attention to the image for the work information.

- You should only apply if your qualifications are a good fit for the position.

- People who are qualified for the position will be given an opportunity to apply.

- The test or interview will only be extended to those who have been shortlisted.

- We will not consider applications that are irrelevant or incomplete.

- Submit your application prior to the closure date.

- No applications will be accepted after the deadline has passed.

How to Apply: For More Details View The Image.

More Jobs : Albaraka Bank Pakistan Jobs 2024

Join Whatsapp Group